The Easiest Way to Verify Your Customers With Confidence

Why Verify(ing) Your Customers Matters

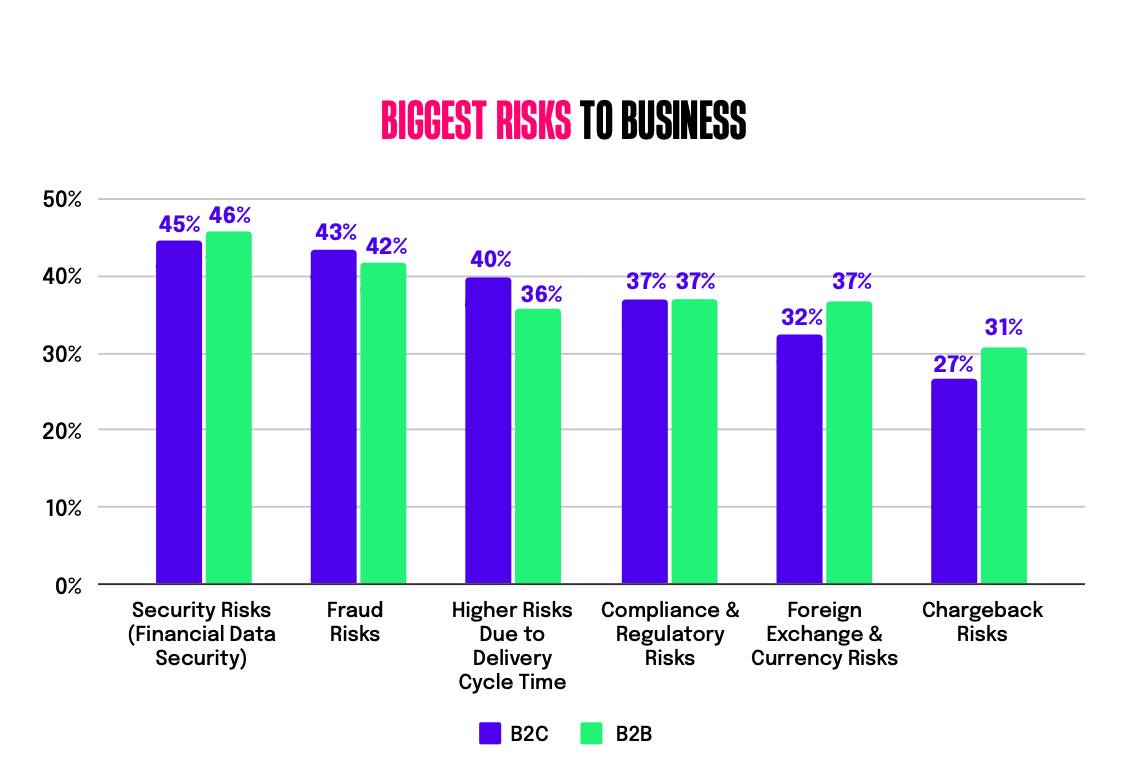

Ensuring businesses are who they say they are is one of the first steps to preventing fraud. Identity verification is a global regulatory requirement and top of mind for businesses. According to Rapyd’s 2024 State of Payments – High Opportunity Industries Report, 42% of the businesses surveyed mention fraud-related risks as a top concern, and 37% also mention managing local compliance and regulatory risks as a key concern.

Boost Your Business’s Credibility and Cut Down on Scams with Rapyd Verify

Rapyd Verify is your go-to solution for a robust Know Your Business (KYB) and Know Your Customer (KYC) process that promises to elevate your credibility and efficiency. Businesses of all kinds can use Verify for automated onboarding including KYB / KYC and risk assessment.

Why Rapyd Verify?

Rapyd Verify stands out by offering a sophisticated, rules-based decisioning and automation system that transforms the traditional KYB / KYC evaluation. This means you can identify potential bad actors before they get a chance to engage with your platform. By integrating comprehensive third-party data enhancement, Rapyd Verify meets both local and global identity verification requirements, ensuring you’re always a step ahead in the fight against fraud.

Verify offers flexibility with two distinct options to suit your business needs:

- Direct API Call:

- Build a fully customizable application with our API, allowing you to create a user interface that aligns with your brand. This option gives you complete control over your data and information, for a more tailored experience.

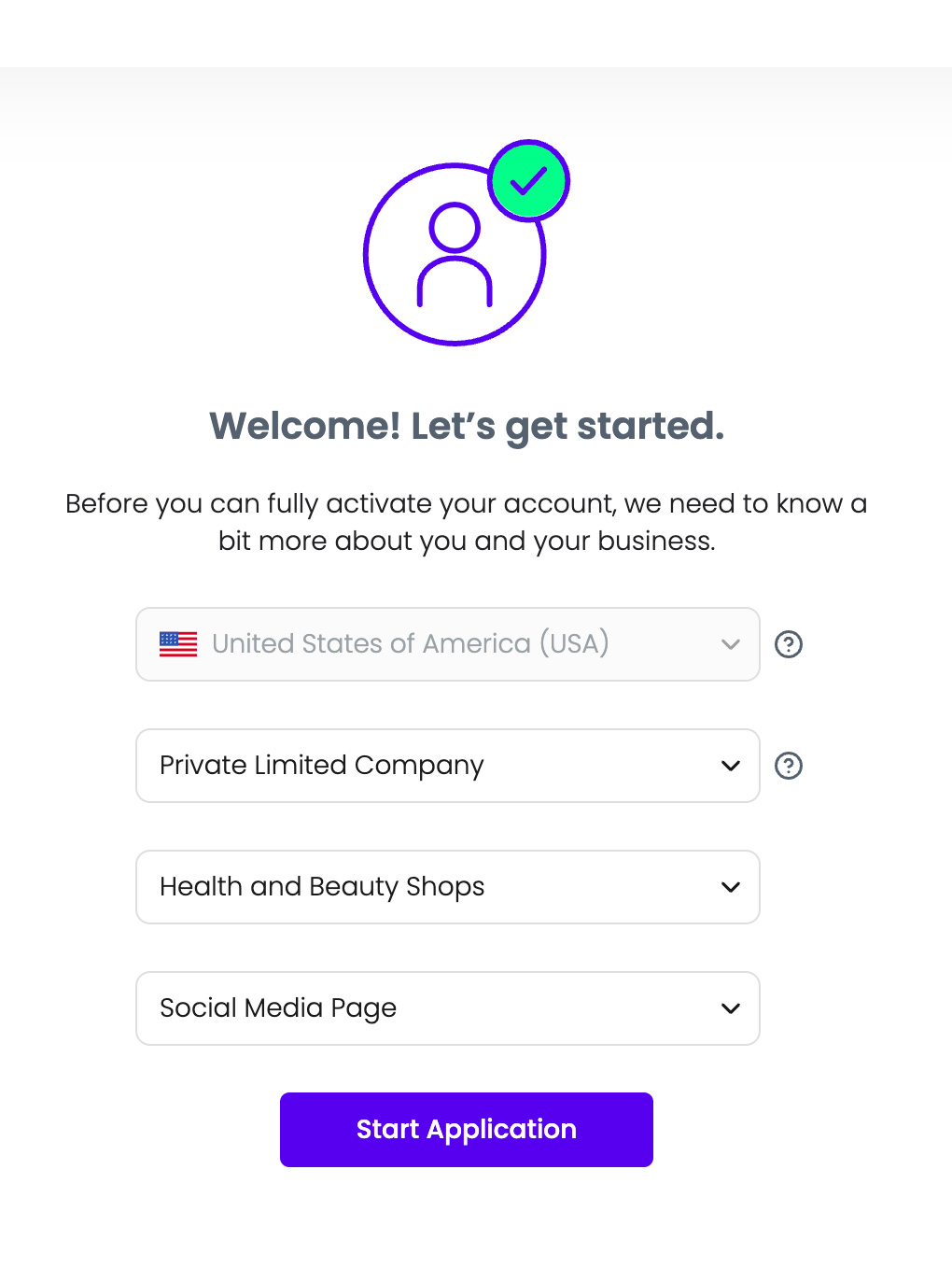

- Hosted Page:

- Use Rapyd Verify’s Hosted Page to collect verification information effortlessly. This hands-off solution simplifies the KYC process, letting you focus on your core business while we handle the verification details.

How Verify Works

1. Submit Information:

For KYC checks, have your end users provide their personal details such as name and address, along with any necessary supporting documents. For KYB verification, businesses will need to submit business registration details, information on business activities, industry sector, key personnel and financial statements.

2. Verify Reviews and Performs an Assessment:

Once information is submitted, the Verify engine will start its assessment. Verify evaluates the details provided and may integrate additional data from trusted third-party sources to ensure a thorough review.

3. Receive Response:

Within a few business days, you’ll receive an approval or denial notification. Verify will assign a unique risk profile that outlines guidelines for transaction limits and other requirements tailored to your business.

Rapyd Verify Benefits

- Ease of Onboarding

With Rapyd Verify, merchants benefit from automated identity verification processes that simplify and accelerate onboarding. This efficiency minimizes friction, so merchants and their end users can get approved quickly and start transacting without delays.

- Proactive Risk Management

Understanding and managing risk is vital for any business. Rapyd Verify equips you with the tools to assess and profile risk health effectively. This proactive approach helps identify high-risk customers and implement measures to prevent fraudulent activities. Additionally, it allows you to quantify risk health and tolerance, giving you a clearer picture of your risk landscape and enabling better decision-making.

Let Your Payment partner do the work for you

Rapyd can help you scale and onboard your merchants and customers efficiently in new and existing markets. Embrace Rapyd Verify to comply with AML regulations, reduce financial crime and boost your business’s credibility. With its automated, comprehensive approach to KYB / KYC, you can streamline your processes, enhance security and ensure a smooth onboarding experience for your merchants and customers alike.